GeoCreDe helps you to sift through maze of banking data on deposits & credit to identify the micro-geographies with business opportunities. The data-driven, map-based platform encapsulates the quarterly data releases on deposits & credit, at districts & towns, released by Reserve Bank of India (RBI).

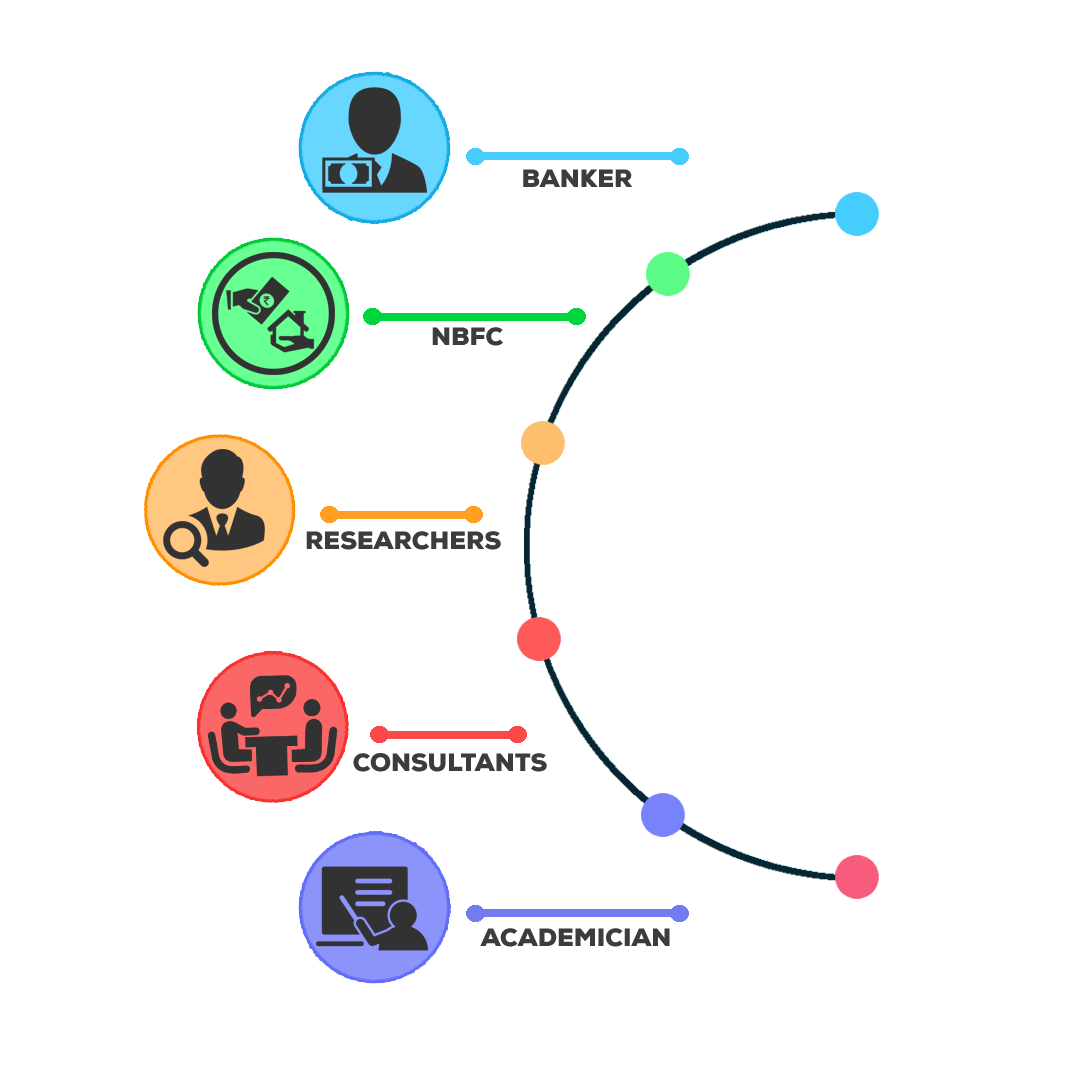

The authentic & comprehensive data released on the banking sector’s – mobilisation of deposits & disbursal of credit, facilitates informed decision-making in Banks & NBFCs as well as in conducting research in consulting & academia.s

The data is sourced from public domain – Reserve Bank of India. The data, as presented by the RBI is in a very non-user friendly manner, especially to undertake time series analysis or extend to detailed analysis on spreadsheet softwares. The downloaded data is normalized and indexed as per database requirements. With upload of every new data release, the datasets are appended to the existing set of data.

We are pleased to inform additional features in GeoCreDe

1. Foreign Direct Investment (FDI) Equity inflows for Districts

The GoI has released quarterly FDI equity inflows at a district level. GeoCreDe captures the quarterly FDI equity flows data series from 2019-20 onwards along with Geo visualisation of the data. Read More

2. Aspirational Districts

Under the ageis of Niti Aayog, the Aspirational Districts program was launched by GoI. GeoCreDe now provides that banking data as well as the Geo Visualisation for the Aspirational Districts.

Close